Income contingent repayment calculator

Federal student loan borrowers pay a percentage of their discretionary income 10 15 or 20 depending on the specific income-driven repayment plan you choose. The maximum variable rate is.

Income Driven Repayment Calculator Fitbux Articles

If you already have a Federal direct loan you may elect income-contingent repayment without having to consolidate.

. The Income Contingent Repayment ICR plan is designed to make repaying education loans easier for students who intend to pursue jobs with lower salaries such as careers in public. This calculator determines the monthly payment and estimates the total payments under the income-contingent repayment plan ICR. This student loan income contingent repayment calculator is easy to use.

Using the same numbers from the example above. Enter your student loan balance and average interest rate. March 10 2019.

ICR at a glance. Income-Contingent Repayment ICR Calculator. If you have multiple student.

How to calculate income-contingent repayment monthly payments. The maximum repayment period is 25 years. Using the same numbers from the example above.

Federal Student Aid. Income-driven repayment plans base student loan payments on a percentage. If you choose the IBR plan your monthly student loan payment would be 149 which is 406 lower than your current monthly payment.

Federal Student Aid. 20 of your discretionary income or fixed payments based on a 12-year loan term whichever is lower. Find Your Path To Student Loan Freedom.

For student loan refinancing the participating lenders offer fixed rates ranging from 273 799 APR and variable rates ranging from 174 799 APR. Heres how it works. With an annual income.

Payments are set at the lesser of 20 of discretionary income or the amount that would be due if you had a 12-year repayment plan. After 25 years any. Finally multiply your discretionary income by 015 then divide that number by 12 to get your monthly REPAYE Plan payment.

Finally multiply your discretionary income by 015 then divide that number by 12 to get your monthly REPAYE Plan payment. For example if you earn 30000 per year are single and live in Pennsylvania 100 of the poverty guideline is 12760. For many borrowers the monthly payment amount under the ICR Plan will be 20 percent of their.

How an ICR Plan Works. The Income-Contingent Repayment plan is an income-driven repayment option for federal student loans. Youd subtract 12760 from 30000 to get your.

Income-Contingent Repayment ICR. 529 Plans 529 Plan Ratings and Rankings. This calculator determines the monthly payment and estimates the total payments under the income-contingent repayment plan ICR.

Ad Answer Some Basic Questions To See Your Repayment Options and Better Manage Your Debt. Income-contingent repayment can reduce your federal student loan payments allowing you to pay 20 of your discretionary income each month or. 529 Plans 529 Plan Ratings and Rankings.

Income-contingent repayment ICR was the first income-driven repayment plan.

2022 Income Based Repayment Ibr Calculator

2

Whose Income Counts For Income Driven Repayment Plans

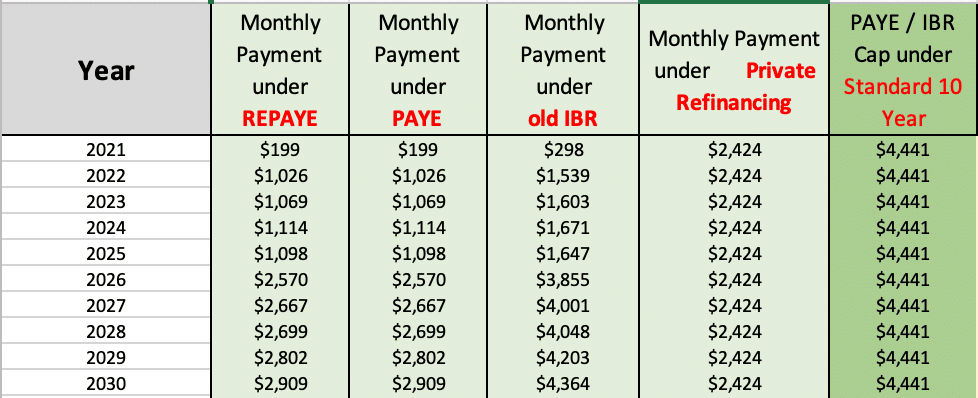

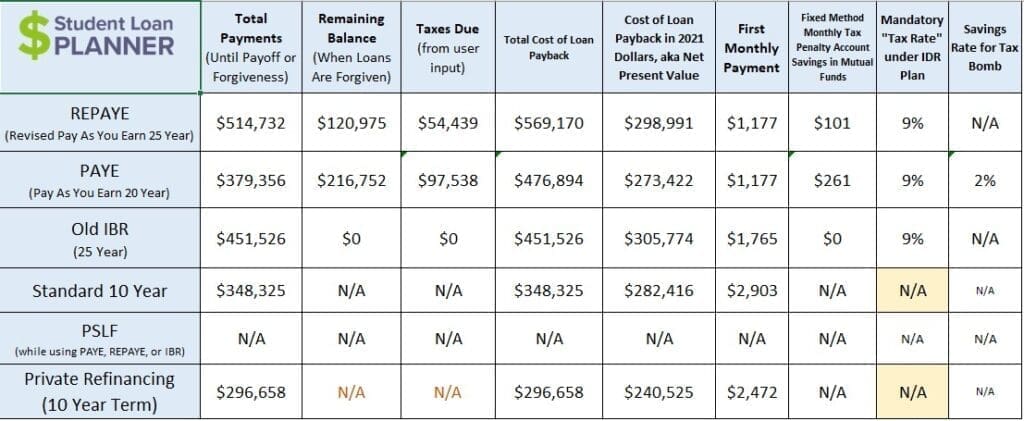

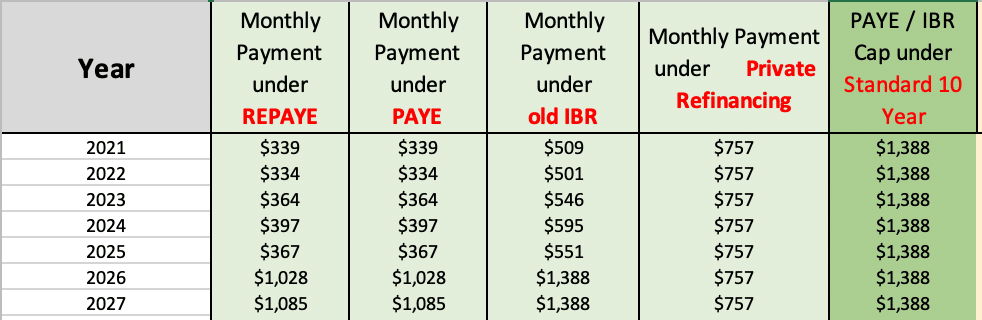

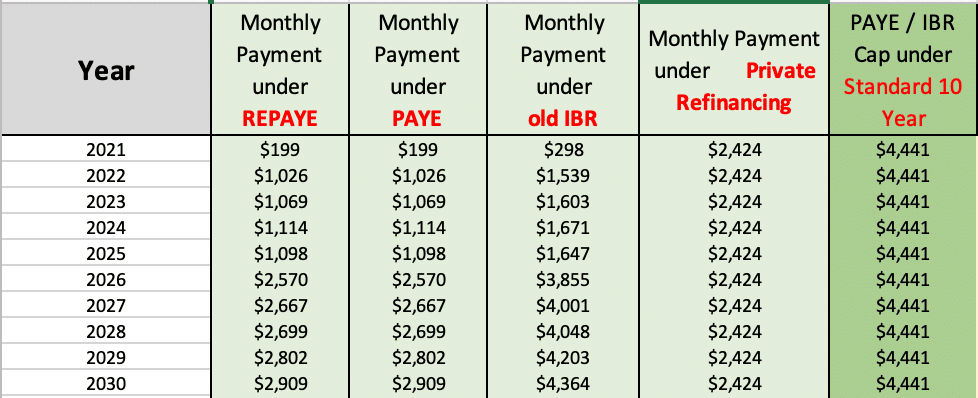

Paye Vs Repaye Vs Ibr How Do They Compare Student Loan Planner

Income Driven Repayment Calculator Fitbux Articles

Income Driven Repayment Calculator Fitbux Articles

Ibr Vs Icr How To Choose The Right Repayment Plan Student Loan Hero

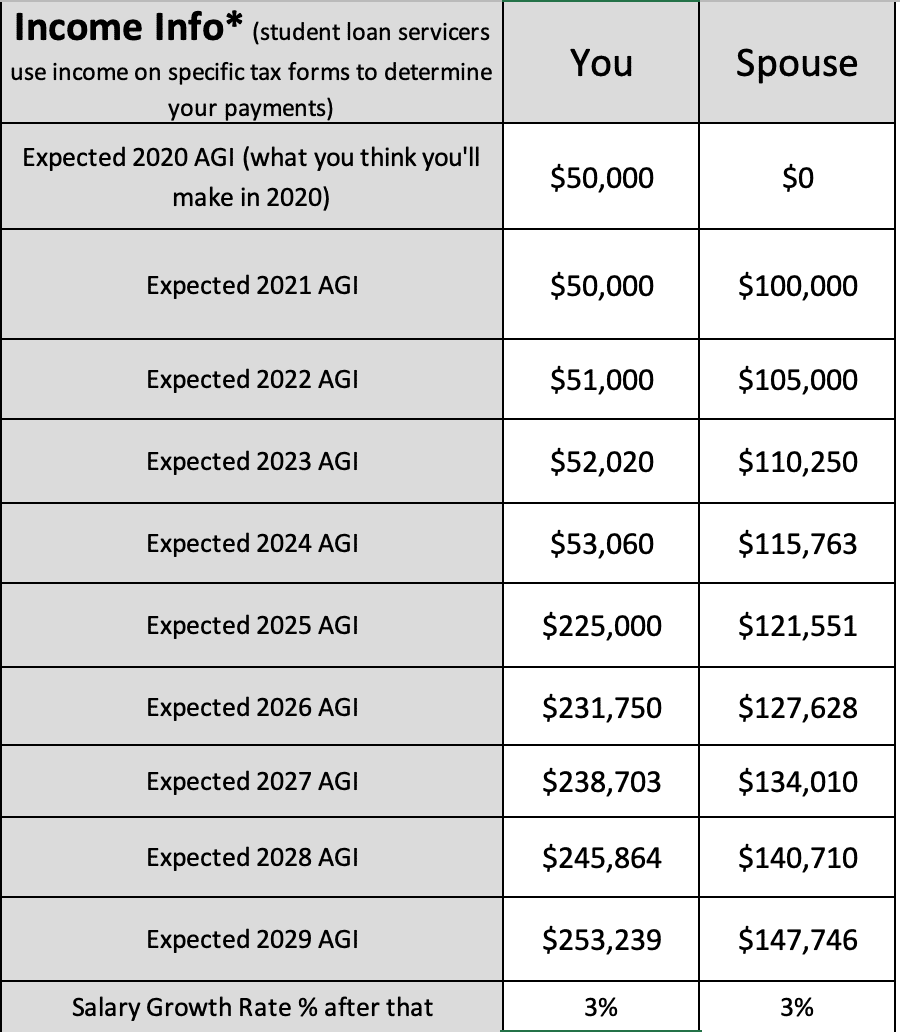

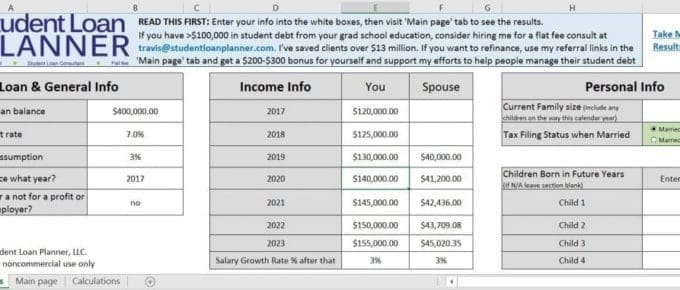

How Income Based Repayment Is Calculated If Your Income Changed Student Loan Planner

How Income Based Repayment Is Calculated If Your Income Changed Student Loan Planner

How Income Based Repayment Is Calculated If Your Income Changed Student Loan Planner

2022 Income Based Repayment Ibr Calculator

Pros And Cons Of Income Driven Repayment Plans For Student Loans

Parent Plus Loan Calculator See All Your Repayment Options For 2022

Student Loan Repayment Calculator 2022 Forgiveness Ibr And Refi

Free Calculators To Do Your Student Loan Forgiveness Math For You Student Loan Hero

What Is Standard Repayment

Defining And Calculating Discretionary Income For Student Loans